Finance4U® Extended Asset Accounting

Finally, you can manage all your asset accounting inside SAP with one elegant solution.

As asset intensive businesses, utilities and energy companies need to comply with property and lease accounting rules for capitalization. This has often involved using and maintaining two separate systems, which is inefficient and costly. But now there’s a truly game-changing option.

Finance4U Extended Asset Accounting enables you to do all your accounting without leaving SAP. As the only SAP certified add-on for asset accounting, it significantly reduces month-end close time and resources, and lowers IT and business operation costs.

Finance4U Extended Asset Accounting simplifies everything.

Automated Asset Capitalization

Automates the capitalization process, automatically generates cost allocation rules, and creates accounting postings along the capitalization process for install and removal work.

Increased Transparency

Enhances the SAP Universal Journal with industry specific categories, and provides plant account balance report and life analysis for regulated assets following the lifecycle defined by FERC.

Ensures Compliance

Retirement posting compliant to public utility accounting principle. Operating lease accounting fulfills new lease standard ASC 842.

Lower Costs

No need for replicating data to a third party asset accounting system, which simplifies month-end closing and your IT landscape.

Proven Track Record

Finance4U products are running today in utility and energy companies across North America.

What our customers are saying.

Leading-edge Technology

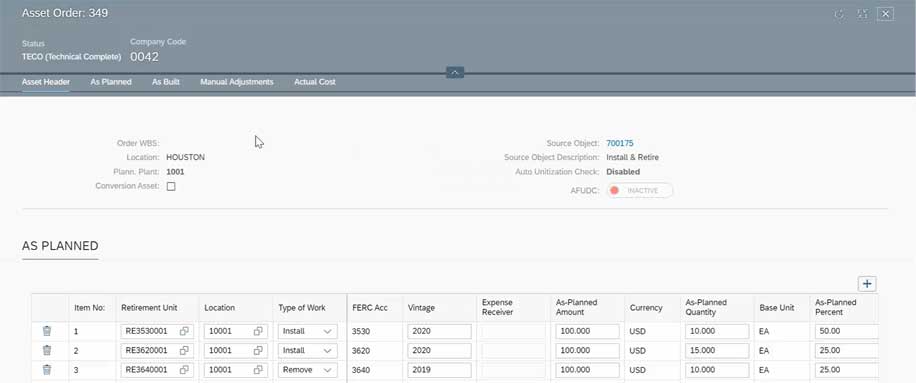

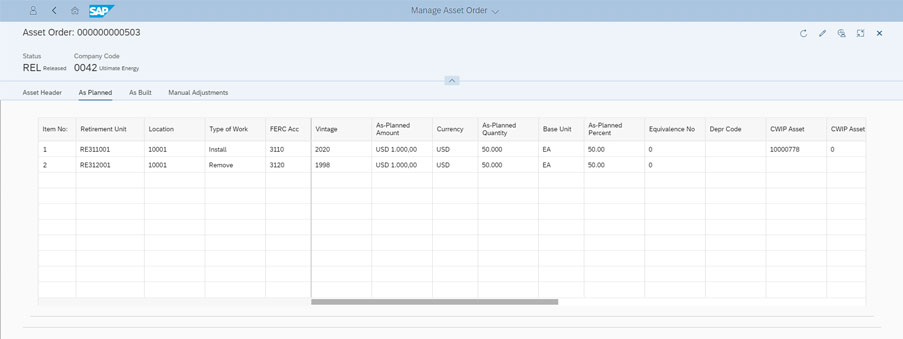

Finance4U Asset Order

Orchestrates the cost settlement from SAP Cost Object to retirement units represented by CWIP and RWIP assets. Automates asset and settlement rule creation, and generates accounting postings along the asset installation or removal work.

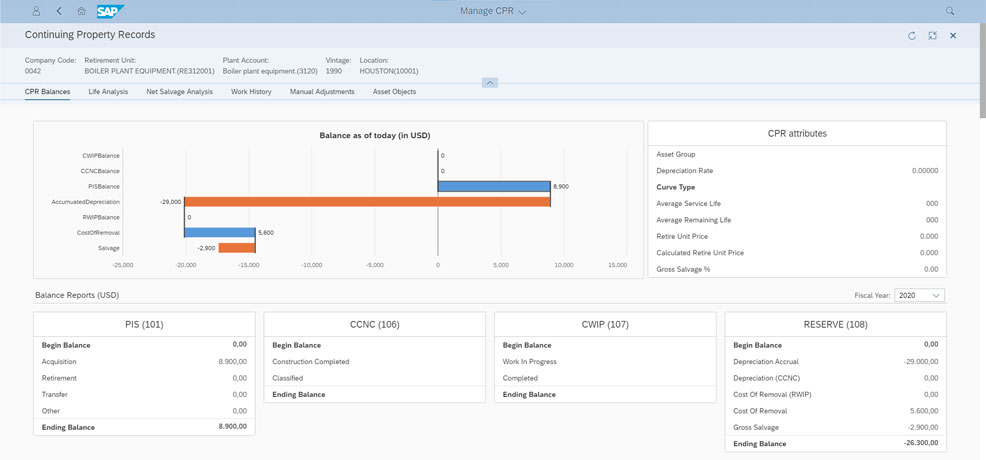

Continuing Property Records

Effectively manages mass asset by retirement unit, plant account, vintage, and asset location. Provides a thorough view on the retirement until balance and its history, as well as vintage-based life analysis and net salvage analysis.

Remove, Retire, and Reserve

Automatically generates retirement postings compliant to public utility accounting standards, with cost of removal, retirement of both original cost and depreciation accrual, and gross salvage into the reserve account.

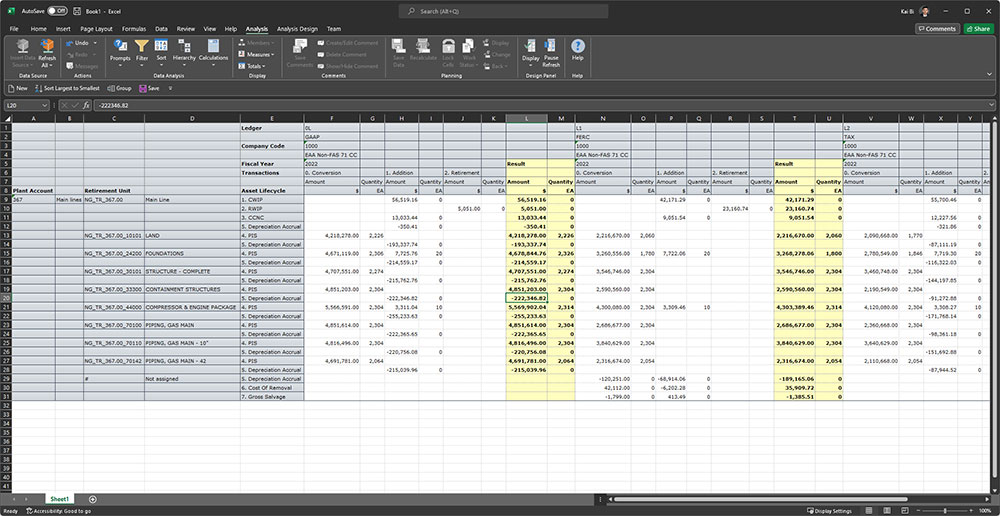

Plant Account Balance Report

Presented on retirement unit or FERC Plant Account (300 series) level, along the life-cycle defined by FERC Account 101 (Plant in Service), 106 (Construction Completed Not Classified), 107 (Construction Work in Progress), and 108 (Reserve).

NRG Optimizes Asset Accounting in S/4HANA

NRG capitalized on their move to SAP S/4HANA to drive more value from

their financial system upgrade. Hear their story of simplification featuring the

SAP add-on that eliminates external solutions and reduces overall TCO.

Why Utegration?

At Utegration, we hire the best people who have the industry and technical expertise it takes to transform utilities and energy companies. Many of our team members were handpicked from the top ranks of SAP. We know our stuff and partner with our clients to bring a higher level of performance to all their operations.

Utegration knows how to help utilities and energy companies get the most out of SAP. It’s been our sole focus since day one, and it’s why we have an unmatched record of 100% success in implementations.

We’re more than experts in SAP for utilities and energy companies, we’re world-class innovators. Our deep industry knowledge spurs us to build software that makes the SAP solution for utilities and energy more complete, drives value for our clients and creates happier stakeholders across the board.

Utegration partners with technology leaders with a proven track record of innovation and leadership in the utility and energy sectors, including SAP, Natuvion, and Workiva.

Contact Us

The Current State of Complexity with Asset Accounting

Learn how utilities are closing the gaps on regulatory and property accounting challenges.

Five Good Reasons to Bring Fixed Asset Accounting into SAP S/4HANA

Given Utegration’s long history of innovation focused on getting the most value from SAP, readers may not be surprised to learn that we’ve taken action to create a better option for managing asset accounting in SAP.

Remove, Retire and Reserve with Finance4U

Ready to simplify your mass asset accounting?